Last Updated on 22/09/2025

Our pensions / Our salaries

Questions about our salaries and pensions are recurring subjects for the Staff Unions. We will tackle the matter in three chapters: The 'Method', the Salaries and the Pensions

I – The 'Method'

Both salaries and pensions are adapted/adjusted yearly using the same unique method expressed in Annex XI of the Staff Regulations (the 'Method'). The 'Method' is not an indexation of salaries. It ensures a parallelism (purchasing power) of our income with the income of the public services of key Member States. The 'Method' is automatic and implemented every year. Its aim is to prevent Member States from sharply reducing or eliminating the adjustment as it was the case in the past (previous Staff Regulations). The 'Method', as adopted by the Council, mainly results from the expertise, the hard work and the negotiations skills of our Federation (USF).

The salaries and pensions adjustment uses parameters calculated by Eurostat:

- prices evolution in Brussels and Luxembourg ('common index') and

- changes in the purchasing power of national civil servants ('specific indicator').

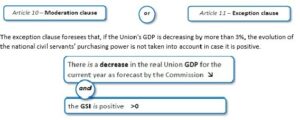

It foresees an exception and a moderation clause:

GDP: Gross Domestic Product

GSI: Specific Indicator

If there is a sharp inflation, an intermediary update of our salary may happen (2022, 2023, 2024, …) to keep up with the rising prices.

The 'Method' is working properly. One may disagree with its mechanism. However, in case of ongoing crisis, having a negative impact on our purchasing power, the main positive point of the 'Method' remains: it is automatic and therefore prevents Member States from intervening in our salaries/pensions' calculation. Besides, in the long term, parallelism with national public services salaries and pensions is globally guaranteed. We stay vigilant though and ready to counter potential attacks to these principles.

II – Salaries

Our salaries depend on our grade (grade at the entry into service and career speed). They are composed of the basic salary and possibly allowances (defined in Annex VII).

A salary grid is set in the Staff Regulations and is updated on a yearly basis using the 'Method' explained above.

The two main types of possible allowances are:

- Expatriation allowance (16%) /foreign residence allowance (4%), linked to the place of employment (and not the home address) and place of origin. It is set at your entry into service. It also depends on the time you lived in elsewhere before you started working for the Institution.

- Family allowances (household (married and/or recognized partnership), dependent child and school allowances (for studies of your kid beyond secondary school and up to their 26th birthday).

Besides, some specialised or 'standby' function as well as management positions also come with their own additional 'allowances'.

These allowances are set in the Staff Regulations or in implementing rules or Commission decisions. Some are updated on a yearly basis linked to the 'Method' which is explained above, others have their own adjustment system and frequency.

Union Syndicale Fédérale-Luxembourg is there to help you check your salary slip beyond the support the corporate services offer.

III – Pensions

More and more colleagues are seeking information regarding their retirement. The usual questions are "At what age can I leave?" and "How much will I receive?".

The main reasons for your concerns seem to be:

- The successive reforms of the Staff Regulations (2004 and 2014) give a general sense of complexity.

- More and more colleagues join the Institutions at an older age and have therefore accumulated entitlements/rights elsewhere. These rights can be transferred IN or OUT the EU pension scheme.

- Colleagues employed from 2004 onwards are generally employed at lower salaries regardless of if they are officials, temporary staff members or contract staff. They are therefore aware that they accumulate 'lower' pension rights.

- Finally, the increase in the retirement age is a source of demotivation. Besides, the general motivation at work in the Commission does not improve either.

Article 77 and Annex VII to the Staff Regulations sets out the conditions for retirement. The key elements are:

- at least 10 years of service,

- a maximum amount set at 70 % of the last basic salary (without other allowances/fees) at an accumulation rate of currently 1.80 % per year of service (almost 39 years to get to a full pension),

- pension entitlement at 66 years,

- minimum pension.

Your pension depends as well on the place where you reside when you go on pension. Also, some allowances mentioned in Annex VII, typically the ones related to your family, (see above) remain.

Union Syndicale Fédérale-Luxembourg is there to help you check your (future) pension rights, next to the support of the corporate services. We have substantial expertise within our Federation (USF).

More information on transfers of rights to the Community pension scheme (IN or OUT):

- Transfer of pension rights: Explanations — Union Syndicale Fédérale (Video in FR)

- Transferring pension rights explained — Union Syndicale Fédérale (Video in EN)

- Webinaire transfert pension IN/OUT (Video en FR)

How much pension will you receive:

- The corporate pension calculator

- The much better developed USF calculator

Disclaimer:

We always try to provide you with the latest information. However, the fast evolution of the situation does not always allow us to timely update this page content. The references hereunder (leaflets and news) might provide you with additional information. However, if you need to have a quick update don't hesitate to contact us: REP-PERS-OSP-USF-LUXEMBOURG@ec.europa.eu

LEGAL BASIS:

- Staff Regulations: Officials: Title V, Annex VII (salary related) Annex VIII (pension) Annex XI (the method of adaptation); Other Agents: Temporary Agents art 19 to 27, 39 to 40, Contract Agents: art 92 to 94 and 109 to 110

RELATED LEAFLETS:

- Our pension scheme: an asset we should protect ! (2/12/2022)

- Salary adjustment: the method, but the method, the wole method (13/10/2022)

- Method, a bulwark against the effects of record inflation (02/05/2022)

- European Salary below the Luxembourg minimum – minimum involvement of institutions (19/01/2021)

RELATED NEWS:

- Intermediate and final salary adjustment for 2023

- report-on-the-balance-of-our-pension-system.pdf (usf-luxembourg.eu)

- Housing allowance and minimum salary Luxembourg-Latest-news.pdf (usf-luxembourg.eu)

- usf-luxembourg.eu/wp-content/uploads/2023/04/Lower-salaries-indexation-in-the-EP.pdf

- usf-luxembourg.eu/wp-content/uploads/2023/04/Pension-and-staff-regulation.pdf

- Salaries-and-indexation-in-Luxembourg.pdf (usf-luxembourg.eu)

- Positive-annual-salary-adaptation-and-stable-pension-contribution-EN.pdf (usf-luxembourg.eu)

- Lower-income-colleagues-EN.pdf (usf-luxembourg.eu)